It is the approved bookkeeping method in the construction industry, viewing the complexities involved. While generally https://www.instagram.com/bookstime_inc accepted accounting principles (GAAP) provide guidelines for accounting for construction contracts, there is no specific standard solely addressing CIP. Instead, companies typically follow GAAP principles to recognize and report construction-related costs.

These extras make CIP or construction in progress accounting relatively more complicated than regular business accounting. The Financial Accounting Standards Board (FASB) defines Construction in Progress (CIP) as the cost of construction work being undertaken on a long-term asset that is not yet ready for its intended use. These costs can include materials, labor, equipment, and overhead expenses, such as insurance and taxes.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission https://www.bookstime.com/ when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

As a result, the construction-work-in-progress account is an asset account that does not depreciate. Financial institutions must maintain accurate and up-to-date records of customer identification documents and transaction history, as per regulatory requirements. CIP plays a crucial role in maintaining the cip account financial system’s integrity by ensuring that financial institutions conduct business with legitimate customers and comply with regulatory requirements.

The operating costs related to a specific period must be charged to the same accounting period. A construction contract is a specific contract negotiated to build a fixed asset or group of interrelated assets. Construction-work-in-progress accounts can be challenging to manage without proper training and experience. Most companies hire a chief financial officer to maintain these records and avoid costly accounting errors.

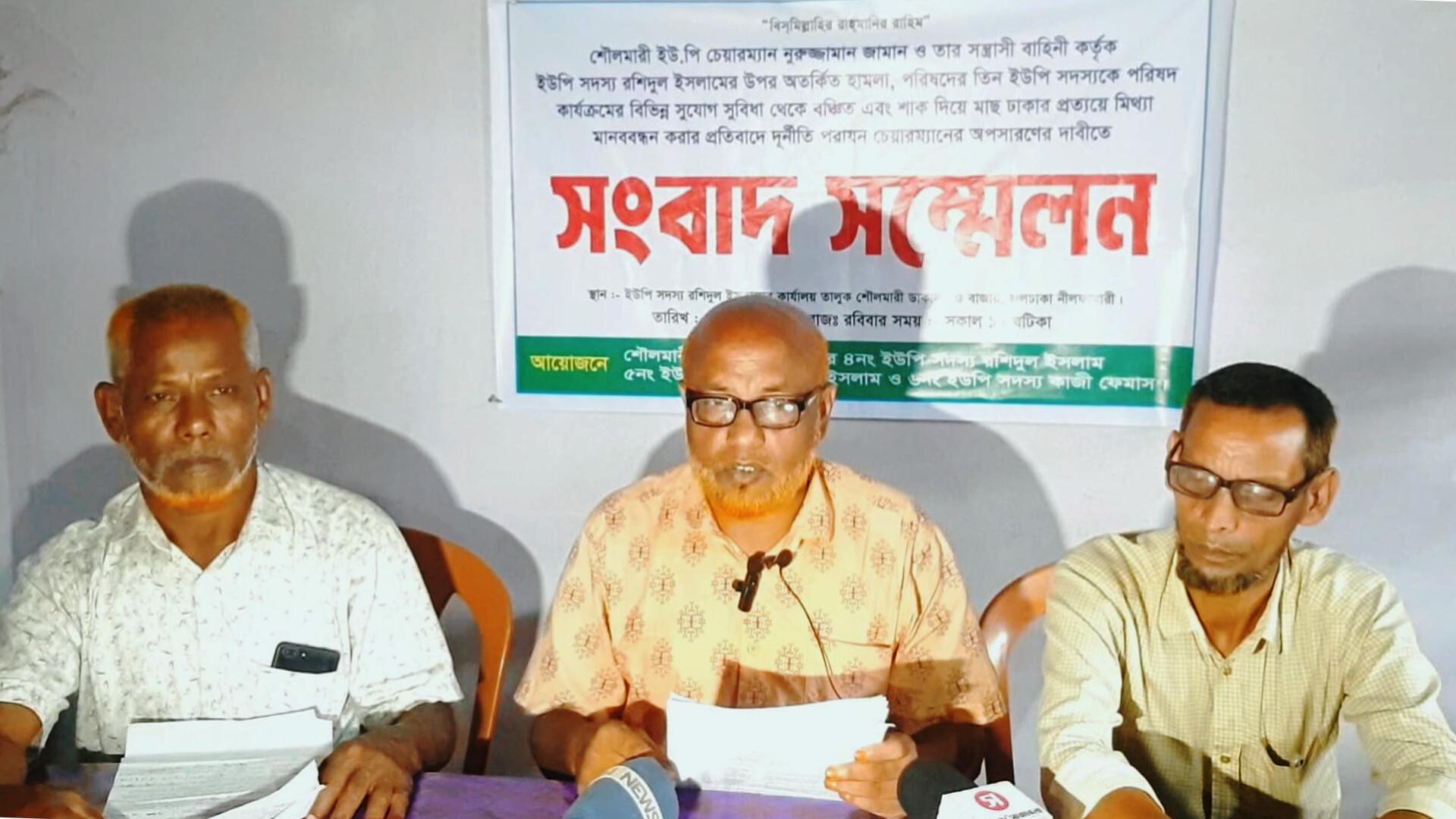

আপনার মতামত লিখুন :